The Rise in Implementing Specialized Loan Collections Systems among Fintech Lenders

Dhiman Bhattacharjee

CEO & Founder, Flux Solutions LLC.

6 Min Read

27 Jul 2023

In the fast-paced world of fintech lending, success hinges on maintaining a robust loan portfolio while minimizing losses. Lenders have long relied on loan servicing solutions to handle the essential administrative tasks of managing loans. However, as the lending landscape evolves, it has become clear that relying solely on loan servicing systems is no longer sufficient. To truly optimize collections efforts and safeguard their financial interests, lenders are turning to a new specialized loan collections system.

In this blog, we will explore why lenders are embracing dedicated loan collection systems, understanding that these sophisticated solutions are no longer a luxury but a necessity in the quest to stay ahead of the game. Let’s delve into the reasons why the integration of loan servicing and specialized collections systems has become the winning formula for lenders aiming to minimize losses and maximize revenue.

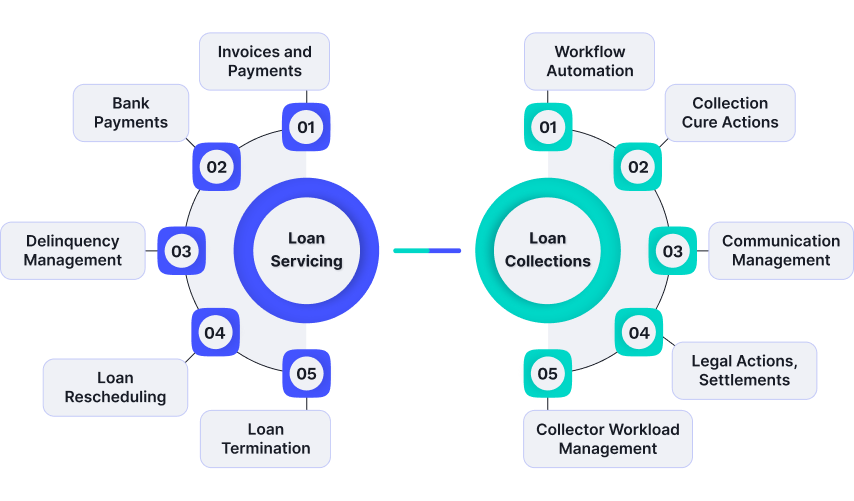

Two Different Systems - Loan Servicing and Loan Collections:

Traditionally, loan servicing systems have been the backbone of loan portfolio management. They excel at generating loan payment invoices, processing payments, maintaining loan statuses, providing instructions to the bank for fund movement between borrower and lender’s bank accounts, and maintaining loan status. However, to elevate lending strategies to new heights, the industry demands more than just general administration.

Specialized loan collection systems emerge as the solution to streamline collections workflows, providing lenders with unparalleled efficiency. While loan servicing focuses on administrative tasks, specialized collections systems are designed to optimize collections processes. A loan collections system provides collections workflow automation for delinquency tracking, collection cure actions, solutions for collections-related legal actions, settlements, and communication management tailored explicitly for the collections process.

Seamless Integration: A Unified View

The true power of specialized collections systems lies in their seamless integration with loan servicing solutions. By establishing real-time data flow between the two systems, lenders can maintain a comprehensive and up-to-date view of borrowers’ accounts. For example, a payment transaction registered in one system must be synced immediately with the other system so that the borrower’s loan information is most current in both systems. That gives lenders a holistic view of the borrower’s account, allowing them to optimize collections efforts.

With a unified view of loan information, lenders can prioritize delinquent accounts, optimize collections strategies, and take targeted actions swiftly. The result is enhanced operational efficiency and a higher likelihood of successful collections, ultimately reducing losses and bolstering revenues.

Functionalities Specific to Loan Collections:

1. Efficiency

Specialized loan collection systems are built to streamline collections workflows and minimize manual efforts. When it comes to loan collections, the thing of paramount importance for a lender is efficiency. The loan servicing system handles broader loan administration tasks, while the loan collections system focuses on streamlining the collections workflows to achieve maximum efficiency. It automates time-consuming manual tasks, such as payment reminders, collection letters, communication scheduling, collector assignment, and collector workload management. This reduces manual efforts, minimizes errors, and ensures timely follow-up with borrowers, thereby saving time and achieving operational efficiency. Moreover, the system intelligently assigns collectors and manages their workloads, leading to reduced errors and improved productivity.

2. Tailored Collections Strategies

Not all loan accounts are the same, each loan account has its unique characteristics and collection challenges. Therefore, a one-size-fits-all approach to collections is no longer viable. Specialized collections systems allow lenders to configure collections strategies based on various factors, such as account age, outstanding balances, and risk levels. This level of customization empowers lenders to adapt their collections approach for each borrower, resulting in higher recovery rates while maintaining positive customer relationships.

3. Compliance and Ethics

Collections activities are governed by strict legal and regulatory requirements. Failing to comply with these rules can lead to severe consequences for lenders.

For example, collections should cease further communication regarding the debt if the borrower sends a written cease-and-desist request to the collector. All communication must stop except to inform the borrower of specific actions they plan to take, such as filing a lawsuit.

Similarly, the law prohibits making collection calls on Sundays or public holidays. A specialized collection system offers features to ensure adherence to collections laws and regulations. In addition, using a collection system allows lenders to maintain accurate record-keeping for collection-specific use cases enabling lenders to mitigate compliance risks, protect their reputation and demonstrate their commitment to ethical collections practices.

4. Data-Driven Decisions

Not all loan accounts are the same, each loan account has its unique characteristics and collection challenges. Therefore, a one-size-fits-all approach to collections is no longer viable. Specialized collections systems allow lenders to configure collections strategies based on various factors, such as account age, outstanding balances, and risk levels. This level of customization empowers lenders to adapt their collections approach for each borrower, resulting in higher recovery rates while maintaining positive customer relationships.

Conclusion:

In the ever-evolving landscape of fintech lending, specialized loan collection systems have become indispensable tools for lenders seeking to minimize losses and maximize revenue. The integration of loan servicing and specialized collections systems allows lenders to unlock new levels of efficiency, compliance, and customer relationship management.

Lenders must embrace this transformative trend to stay competitive as the lending industry continues to recognize the value of specialized collections solutions. By implementing cutting-edge collections systems, lenders can proactively manage delinquencies, optimize collections workflows, and cultivate positive customer relationships.